Want to send money to Nigeria from Canada? There are several options!

You can transfer money from Canada to Nigeria through digital transfer companies or do a traditional wire transfer through your local Canadian bank.

Keep in mind that digital money transfer companies and apps will typically cost you less than using traditional Canadian banks.

- The Best Ways to Send Money to Nigeria from Canada

- How to Send Money from Canada to Nigeria: Review of The Best and Cheapest Options

- 1. Send Money from Canada to Nigeria with WorldRemit Money Transfer

- 2. Send Money to Nigeria from Canada with TransferWise (now: Wise) Money Transfer

- 3. How to Send Money from Canada to Nigeria with Remitly

- 4. How to Send Money from Canada to Nigeria with Xoom

- 5. How to Send Money from Canada to Nigeria through Western Union

- Send Money to Nigeria from Canada: What to Consider When Choosing Your Money Transfer Company

- How to Transfer Money from Canada to Nigeria through Digital Money Transfer

- What Documents Will You Need to Transfer Money from Canada to Nigeria?

- What Documents Does the Recipient Need to Receive Cash in Nigeria?

- How Can I Send Money from Nigeria to Canada?

- FAQs: Transfer Money from Canada to Nigeria

- Final Words on How to Send Money to Nigeria from Canada

There are many digital money transfer provider options you can choose from, but the best one depends on specific factors. We’ll discuss these factors in the article and look at the best and cheapest money transfer companies available.

Let’s get started!

The Best Ways to Send Money to Nigeria from Canada

2022 Update: The Central Bank of Nigeria (CBN) released a directive in December 2020 that prevents money transfer providers from offering transfers to Nigeria in the Nigerian Naira (NGN), but only in US Dollars (USD).

There are different routes or channels you can take to send money to Nigeria from Canada, as explained below:

Digital Money Transfers

When it comes to money transfers to Nigeria from Canada, digital money transfers usually come with the lowest transfer fees and strongest exchange rates.

Some of the money transfer companies allow you to transfer directly to Nigerian bank accounts, while others allow you to physically pick up the money in US dollars. Sending money through a digital money transfer service usually takes one to two days.

Cash Transfers

Due to Nigeria’s restrictions, it is tough to send naira from Canada to Nigeria for cash pickup. You’ll have to send US dollars. International money transfer services allow you to transfer money from Canada to Nigeria for cash pickup at a local Nigerian branch.

This service usually takes about fifteen minutes. While speed is a great advantage, the convenience comes with high fees and weak exchange rates. If you must go through a cash pick-up, there are other money transfer services apart from MoneyGram. Compare them and weigh their perks before deciding on any. We’ll discuss some of them later in the article.

Comparison of Digital Money Transfer vs Cash Transfer

Example: Let’s assume you are sending $1,000 to Nigeria. As of Jan 13, 2021, the table below how the transaction might go.

| Parameters | Digital Money Transfer Service | Cash transfer |

| Exchange rate | 1 CAD = 0.7743 USD | 1 CAD = 0.7534 USD |

| Transfer fee | $0 | $5 |

| Speed of transfer | 1-2 days | Around 15 minutes |

| Amount received | $774.30 | $748.40 |

| Conclusion | It offers the best value but takes a longer time. | Faster service, but it’s a little costlier. |

Banks

Compared to online money transfers and cash transfers, wiring money abroad via banks attracts higher fees and a wider margin on the exchange rate. Sending money through your local bank will most likely be more expensive than other options so before wiring money, try to shop around.

How to Send Money from Canada to Nigeria: Review of The Best and Cheapest Options

✅ We only compare regulated and secure money transfer providers, which we have researched and tested.

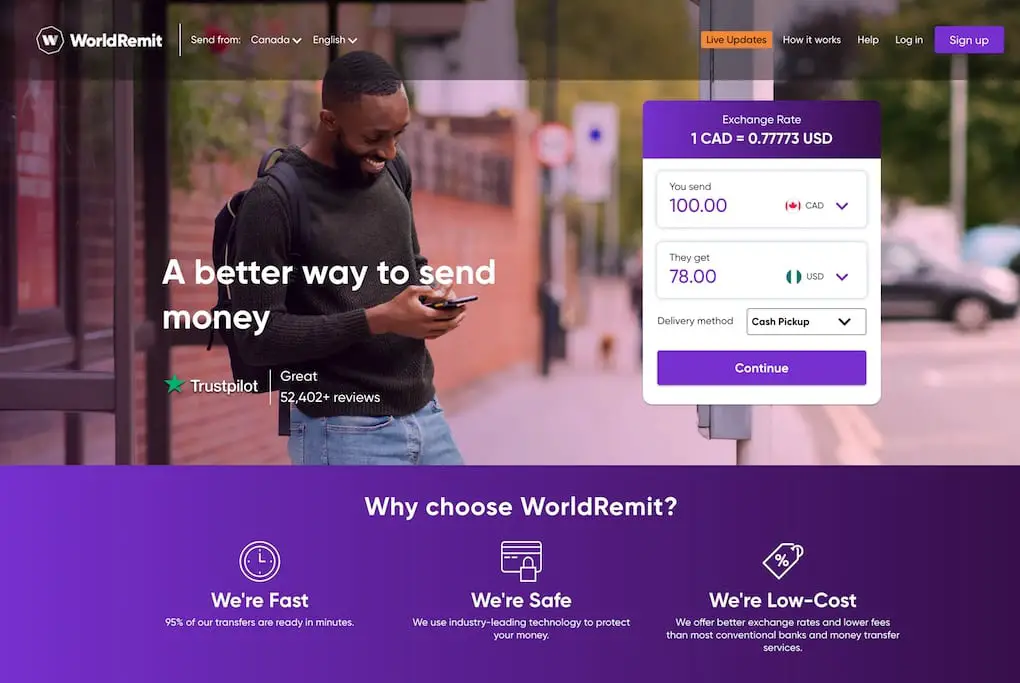

1. Send Money from Canada to Nigeria with WorldRemit Money Transfer

WorldRemit is a highly reputable money transfer service founded by Ismail Ahmed in 2010. It currently has over 4 million customers and supports more than 90 different currencies across 150 countries, including Nigeria. WorldRemit is usually the cheapest option.

After a new directive from the Central Bank of Nigeria (CBN), bank transfers and cash pickup with WorldRemit are now sent in US Dollars only.

Safety: They are registered by the Financial Conduct Authority, so your money is safe.

Delivery Options

Your recipient in Nigeria can receive their funds through any of these delivery options: cash pickup, bank deposit, airtime pick-up, and mobile money transfer.

Cash Pickup

When you send money to Nigeria from Canada through WorldRemit’s cash pick-up service, your recipient can collect cash from any Fidelity Bank, FCMB Bank, Zenith Bank, Access Bank, and Polaris Bank branch.

The transaction usually takes only minutes and the maximum amount you can transfer for cash pickup in a day is NGN 1 million or equivalent.

Bank Transfer

You can transfer money from your Canadian account to your loved ones’ savings or checking account in Nigeria. All you have to do is send the money to their bank account n any of these banks, and they will be credited immediately- Zenith Bank, First Bank, UBA, Polaris Bank, Access Bank, and GT Bank.

Usually, a bank transfer takes only minutes, but it can take a few days in some rare cases. The highest amount you can send per day via bank transfer is NGN 7 million or equivalent.

Airtime Top-Up

You can also send airtime directly to your recipient on Nigeria’s mobile phone. Top up their prepaid phones on the MTN, GLO, Etisalat, Airtel, and Visafone networks, and they will receive it instantly or in a few minutes.

Sign up for a WorldRemit account using >> this unique link << and receive a voucher for $30 CAD

WorldRemit Transfer Fees and Exchange Rate

WorldRemit’s fees start from 2.69 CAD, and it increases depending on how much you are sending and your chosen delivery method.

The company’s exchange rate is slightly higher than the mid-market or interbank rate. The highest amount you can send from Canada to Nigeria per 24 hours is $40,000.

Sample Transaction

Suppose you are sending CAD 1,000 to Nigeria on March 18, 2021. For cash pickup, you’ll pay 2.99 CAD. The 2.99 CAD is charged as an additional fee, so you will be paying 1002.99 CAD in total. Your recipient will receive 786.00 USD based on the 1 CAD = 0.7860 USD exchange rate.

Payment Methods and Mobile App

You can pay for your WorldRemit transfer through debit, credit card, Poli, bank transfer, Interac, Klarna, iDEAL, Apple Pay, and Trustly. They have a mobile app available on both Android devices and iOS. Transfers through the app go through within minutes.

Perks of Using WorldRemit

- They are a cheaper alternative to high-street money transfer companies for remittances.

- Their mobile app is highly-rated for receiving and sending money.

- They have a large and growing number of payout networks and countries.

Downside

- When it comes to transferring large amounts of money or transfers to bank accounts, they are not always the cheapest provider.

You’re Invited >> Sign up for a WorldRemit account, using referral code CHARITYA78.

Send a transfer of at least $100 CAD, WorldRemit will email you a voucher for $30 CAD!

2. Send Money to Nigeria from Canada with TransferWise (now: Wise) Money Transfer

In 2021, TransferWise suspended money transfers to Nigeria. At this time, it is unknown when TransferWise will resume transfers from Canada to Nigeria.

Wise, formerly known as TransferWise, is an excellent money transfer service and one of Canada’s most popular. The company is highly reputable and is trusted by over 8 million customers.

Currently, they offer money transfer services to over 70 countries, including African countries like Nigeria, Niger, Ghana, Ivory Coast, Senegal, Mali, Togo, and Zambia.

Safety: The Financial Transactions and Report Analysis Centre of Canada (FINTRAC) regulates the company, so your money is safe.

Wise Fees and Exchange Rate

Wise is called the “Robin Hood” of the money transfer industry because of its low and very transparent fees. The company focuses on making transfers more affordable than what you’ll get at traditional banks.

They do this by offering customers low and transparent transfer fees as well as mid-market exchange rates. You’ll pay a flat fee of 2.08 CAD plus 0.75% of the amount you are converting to Naira (you’ll see the total fee upfront).

Their exchange rate is the real rate or mid-market rate set by the market for currency conversion. It has zero markups, and you’ll save a lot of money compared to using non-mid-market rates.

Sample TransferWise Transaction

Suppose you are sending a total of CAD 1,000 by direct debit on March 18, 2021; your total fee is calculated as follows:

- Fixed fee: 2.08 CAD

- % fee: 0.75% of 997.92 CAD = 7.48

- Your total fee: 2.58 + $7.48 = 10.06 CAD

- Total amount converted = 1,000 CAD– 10.06 CAD = $989.94 CAD

So, the total amount you’ll be sending to your recipient after removing transfer fees will be CAD 989.94.

Note: The percentage fee varies with how much you are sending and will reduce for larger amounts.

- % fee for transfers up to 173,260 CAD- 0.75%

- % fee for transfers up to 519,780 CAD- 0.65%

- % fee for transfers up to 866,300 CAD- 0.6%

- % fee for transfers up to 1,732,600 CAD- 0.59%

- % fee for amounts above 1,732,600 CAD- 0.58%

Payment Methods and Mobile Apps

Wise mobile apps have excellent ratings on Google’s Play Store and Apple’s App Store. According to Wise customers’ reviews, the mobile app is an invaluable tool for anybody moving money internationally.

You can pay for your transfer through bank transfer, debit card, credit card, and direct debit. Usually, transfers generally occur within a day. Depending on your payment method, your transfer may occur immediately, as long as you have been verified.

For people who want to pay in multiple currencies, Wise also offers a multicurrency account, Wise Borderless Account.

Perks of Using TranferWise (now: Wise)

- They offer the true mid-market exchange rate

- Transparent and low transfer fees

- Superb user experience

Downside of Wise

- You can only send money to one bank account.

3. How to Send Money from Canada to Nigeria with Remitly

Remitly is a digital international money transfer service that allows people in Canada, the U.S., Australia, the Eurozone, and the U.K. to send money to more than 85 countries, including Nigeria. Apart from online money transfers, it also offers cash pickups at thousands of locations.

Safety: Remitly is regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). FINTRAC is Canada’s financial intelligence unit, so your account and funds are secure. The website also has 256-bit encryption, which protects your account.

Delivery Options

Bank Deposit- When you select bank deposit as your delivery method, they deliver the money directly into your beneficiary’s bank account. Remitly currently offers bank deposit delivery to Polaris Bank and GT Bank in U.S. dollars.

Cash Pickup- If you select cash pickup as your delivery method, your recipient can collect the money in US Dollars at any branch of Polaris Bank, GT Bank, and Fidelity Bank.

Remitly Transfer Fees and Exchange Rate

The total amount you are sending and the delivery speed determine your transfer fees. Remitly has two delivery speeds- Express (takes a few minutes) and Economy (within 3-5 business days).

For example, if you transfer an amount between $1,000 and $1,499.99 through Express delivery, you’ll pay a fixed fee of $14.99. The fee will be lower if you transfer a lower amount or are using Economy delivery.

Remitly’s Exchange rate is not as competitive as that of Wise. It is marked up and up to 2% worse than the mid-market rate.

Other factors that affect the exchange rates are:

- How much money you are sending.

- How you are funding your transfer.

- The transfer service you select.

Payment Methods and Mobile App

Remitly allows you to pay via credit card, debit card, or bank transfer. If you pay via Express delivery, you must use a credit or debit card. Remitly has a mobile app for both Android and iPhone devices. With the app, you can send money to Nigeria from Canada in just a few taps.

Perks of Using Remitly

- The mobile apps have a simple and user-focused interface which makes them very easy to use.

- You can lock in your exchange rates once you make your transfer to evade currency fluctuations.

- Both the sender and the recipient gets SMS / text message alerts so you can track your transfer and know when it has been paid and received.

- Remitly has a 100% satisfaction guarantee, which means if you aren’t completely happy with the service, you will get your fees back.

Downsides

- The fixed fees are expensive when transferring smaller amounts.

- The exchange rate is not the best in the market. Some other providers offer better rates.

4. How to Send Money from Canada to Nigeria with Xoom

Due to FX restrictions placed by the Central Bank of Nigeria (CBN), Xoom has suspended money transfers to Nigeria. At this time, it is unknown when Xoom will resume transfers from Canada to Nigeria.

Xoom is an online money transfer service belonging to PayPal. They offer money transfers to 160 countries, including Nigeria. Apart from sending money, you can also pay your bills and reload your mobile phones with Xoom.

Transferring money usually takes a couple of minutes, but when they need to make checks due to your funding method, the transfer can take a few business days.

Safety: Paypal manages Xoom, and it is regulated by the U.S. federal government and several state governments and agencies. They also use 128-bit encryption on the website to keep your private information secure.

Delivery Methods

Your beneficiary can receive money through bank deposits and cash pickups. Xoom cash pickup is available at FCMB, First Bank, Union Bank, Access, Ecobank, Fidelity, and a few other Nigerian banks.

Xoom Money Transfer Fees and Exchange Rate

Xoom’s fixed transfer fee differs based on the payment method. The exchange rate is lower than the mid-market or interbank rate.

Payment Method and Mobile App

You can pay through your bank account, credit card, debit card, or PayPal balance. Xoom has highly-rated mobile apps for Apple iOS and Google Android devices. The apps give you updates on your transfer status via email notifications or texts.

Perks of Using Xoom

- They offer fast transfers.

- The customer service is reliable.

Downsides

- Their exchange rate is not transparent, and their fees are relatively high.

5. How to Send Money from Canada to Nigeria through Western Union

Western Union is one of the oldest and most recognized d money transfer providers worldwide, with a 150 million customer base. It offers competitive fees, easy usage, and has expansive coverage. The delivery time depends on factors like the amount being sent, agent location hours, service selected time zones, etc.

Delivery Options

- Cash pick up at an agent’s location- option 1: Money in Minutes – the money is available for pick up within a few minutes. Option 2: Next Day – the money is available for pick up the next working day.

- Mobile Money Transfer- You can transfer to the recipient’s mobile wallet.

- Bank deposit – it takes 2-5 working days.

Western Union Fees and Exchange Rate

Sometimes, Western Union Online offers competitive transfer fees and exchange rates different from what you’ll get at the traditional cash-based transfer at an agent location. Like many money transfer services, their exchange rate is slightly higher than the mid-market rate as this is where part of their profit comes from.

The exchange rate also varies with your transfer fee and delivery method. Larger transfers enjoy better rates, so if possible, a good decision would be to bundle a few of your transfers.

Payment Method and Mobile App

When transferring funds with Western Union, you can pay with a debit or credit card, cash at an agent location, or straight from your bank account.

Western Union has an excellent mobile app on both iOS and Android. You can scan your credit or debit card on the app using your phone’s camera to get started. Then you’ll set up your money transfer on the app, but you’ll have to follow up and complete the transaction by paying in cash at any agent location.

The Western Union mobile app also allows you to track your transfer’s progress of a past transfer, estimate your fees, or find a close agent location for future transfers. The app is safe to use as it offers one-touch fingerprint logins.

Perks of Using Western Union

- They have a vast network of agent locations worldwide.

- You can send money via several channels, such as Western Union agent locations, on its mobile app, website, mobile app, or phone.

- They offer consumers and businesses a wide range of services.

Downside of Western Union

- The exchange rate margins are not transparent

PRO-TIP: If you are looking to save on fees, do NOT use Western Union, as they have one of the highest fees when compared to other international money transfer providers. Western Union also makes money on currency exchange, thereby costing you more.

Send Money to Nigeria from Canada: What to Consider When Choosing Your Money Transfer Company

To get the most out of your money transfer, compare the money transfer providers using the following factors:

Security

Check if the money transfer company is well-known and regulated by a trusted body such as a government agency. Then check their reviews online and weigh what people are saying about their service. Another thing you should check is how secure their app is.

Transfer Fees

Transferring money internationally usually attracts fees. However, some companies hide the fees in the exchange rate. Select a company whose transfer fee is available upfront and reasonable to avoid a situation where hidden fees get deducted before the beneficiary gets the money.

Also, if you are sending a large amount of money, it’s better to go with a company that pays a flat fee so you can get a stronger exchange rate.

Reasonable Exchange Rates

Some money transfer providers offer $0 transfer fees, but they make up for it by offering exchange rates that are significantly higher than the mid-market exchange rate. You’ll end up paying more in fees than other providers due to the exchange rate.

The CAD-USD exchange rate fluctuates daily but locking in an exchange rate may help you save money. Therefore, find out if the provider offers a guaranteed exchange rate that remains the same for some hours (or 1-2 days) and lets you lock in a rate.

Transfer Speed

Check if the company offers instant and same-day money transfers. Your payment method can also affect your transfer speed, so before going with any company, read their print to know how each payment method can extend the time it takes to process your transfer completely.

Convenience

Weigh the company’s transfer options and delivery methods and go for the one that offers the most convenient choice for you.

Transfer Limits

Companies have varying transfer limits. Most times, the higher the amount you are sending, the lower your fees. So, ensure you pick a provider that will not limit you.

Customer Service

An excellent money transfer company should offer great customer service. Their customer service representative should be readily available to talk or answer questions concerning your transfer.

How to Transfer Money from Canada to Nigeria through Digital Money Transfer

The following is a typical standard process of how to transfer money from Canada to Nigeria using a digital money transfer service:

1. Sign up for a free online account: Choose a money transfer provider and create a free online account by submitting your proof of ID, contact information, and your desired payment method.

2. Provide necessary transfer details: Once you have your account ready, you can commence transactions. Enter the recipient’s contact information, choose how much you want to send, and select a delivery method. If you’re transferring the money directly to a Nigerian bank, you’ll need to provide your recipient’s bank account details.

3. Confirm transfer information: You should double-check your destination, payment method, and expected fees.

4. Save your receipt: Save your receipt confirmation number so you can track your transfer’s progress till it gets to your recipient in Nigeria. Some money transfer providers make your life easier by sending you a text or email once your transfer is complete.

Payment Methods for Sending Money to Nigeria

There are various available payment methods for international transfers. Most of the time, they should be:

- Credit Card.

- Debit Card.

- Bank Transfer.

How Long does it Take to Transfer Money from Canada to Nigeria?

The duration of an international transfer till the recipient gets it depends on:

- Payment methods.

- If you are sending on a public holiday or weekend.

- Potential security checks.

What Documents Will You Need to Transfer Money from Canada to Nigeria?

To send money to Nigeria from Canada, you’ll need these documents and details:

A government-issued ID

When making your first transfer, most services will ask for a government-issued means of identification such as a passport or driver’s license. This is usually to serve as a regulatory requirement to prevent money laundering. Some services allow you to send transfers without any Identification, but they may ask for your Social Insurance Number (SIN).

Proof of address

Depending on your payment method, you might need to submit your proof of address, such as a bank statement or utility bill.

Payment method

Your money transfer service may accept debit or credit cards, personal cheques, cash, or bank accounts.

Recipient details

Submit your recipient’s information such as their name as it appears on their ID, phone number, Nigerian bank account, and routing number if you are sending it directly to their bank.

You might be asked to provide additional documents if you are transferring a very large amount of money.

What Documents Does the Recipient Need to Receive Cash in Nigeria?

To pick up the money sent to you in person, you may need these documents:

- Government-issued ID: You may be asked to provide your Nigerian Passport or other ID issued by the National Identity Management Commission (NIMC) to pick up your transfer in cash.

- Transfer number: You’ll need the transfer confirmation details, i.e., a PIN, a reference number, a tracking number, or an MTCN. The sender can forward this.

- Sender’s information: This covers the sender’s full name, country, and address if known.

- Amount sent: You may also need to know how much the sender sent.

How Can I Send Money from Nigeria to Canada?

Whether you are purchasing a property in Canada, compensating employers in Canada, repatriating funds, paying overseas suppliers or sending money to your loved ones or dependent in Canada (such as an international student), you can send money from Nigeria to Canada safely through these methods.

1. Wise

Wise (formerly TransferWise) will offer you the best value for your money when transferring US dollars to a bank account in Canada in Canadian dollars. They offer the most dollars for your money with low transfer fees.

Their exchange rate is also equivalent to the mid-market rate.

In 2021, TransferWise suspended money transfers to Nigeria. At this time, it is unknown when Transferwise will resume transfers from Canada to Nigeria.

The next cheapest alternative to Wise to send money from Nigeria to Canada is WorldRemit.

2. Western Union

Once you have the recipient’s information, you can walk into any Western Union authorized dealer, usually banks, with the equivalent amount you intend to send in naira plus a little fee they may charge.

Some banks require you to open an account with them before you can carry out the transaction, while other banks may only need your BVN.

PRO-TIP: If you are looking to save on fees, do NOT use Western Union, as they have one of the highest fees when compared to other international money transfer providers. Western Union also makes money on currency exchange, thereby costing you more.

3. Wire Transfer

To carry out a wire transfer, you will need to open a USD domiciliary account and fund it with the equivalent amount you want to send in dollars. Add your bank’s commission to the money and proceed to wire.

You’ll then be asked for the recipient’s details, either the dollar account or his local account. Note that you can only wire dollars directly from Nigeria to USD.

4. Cash Swap

You can look for a trusted family member or friend in Canada, or the bureau de change workers to send the equivalent amount you want to transfer to your recipient in Canada.

In return, you will credit the person’s local account in Nigeria with the Naira amount.

FAQs: Transfer Money from Canada to Nigeria

Final Words on How to Send Money to Nigeria from Canada

The article covers the best and cheapest money transfer companies that you can use to send money to Nigeria from Canada. Each of them has its perks and downsides, and comparing transfer fees and exchange rates between these money transfer providers can save you a lot of money.

TransferWise offers excellent value for money due to its low fees and competitive mid-market exchange rate.

WorldRemit, Remitly, and Xoom use different exchange rates from the interbank rate, and this is one way they make a profit. However, despite that, they offer better value, and you’ll save money compared to using the traditional bank wire.

Overall, before making your transfer, use this article as a guide and compare their fees, exchange rate, and other factors like credibility, speed, transfer methods, transfer limits, and credibility.

Is there a money transfer service that you are currently using to send money from Canada to Nigeria? Comment below and let us know.

READ ALSO >> How to Transfer Money from Canada to the US

AUTHOR

Charee Oisamoje is the founder of CanadaWiz. She leads the editorial team, which is comprised of subject matter experts that aim to create well-researched, highly detailed content related to studying, working, immigrating, and settling/living in Canada as a newcomer.

Charee's personal experiences as a Canadian immigrant and her professional competencies make her uniquely qualified on the subject matter.

With extensive educational credentials, she is an expert at collecting details, verifying facts, and making complex subjects easy to understand.

Learn More >> About Page

🏆 Best Offers This Month

📌 Get $3,000 Free Transfer and Earn $75 Referral Bonus

✔️ Get up to $3,000 CAD* Fee-Free transfer (or the equivalent of £2,000 in other currencies).

✔️ Earn $75 CAD** for every 3 friends you refer; they'll get a fee-free transfer of up to $800 CAD.

✔️ Multi-Currency Debit Card: Spend abroad without hidden fees.

✔️ Best and real exchange rates and lower fees than old-school banks and other money transfer services.

*Your secret code will be automatically applied.

**USD accounts earn $115 USD for every 3 friends you refer; they'll get a fee-free transfer of up to $600 USD).

📌 Low-Cost International Money Transfer with $30 Cash Bonus

✔️ Get a $30 welcome bonus for transferring $100* or more.

✔️ Get a 20 GBP welcome bonus for transferring 75 GBP* or more.

✔️ Fast: 95% of transfers are received by the recipient in minutes.

✔️ Better exchange rates and lower fees than most traditional banks and money transfer services.

*This can be achieved over multiple transfers.